Escolha o Destino e Tenha uma

Experiência inesquecível

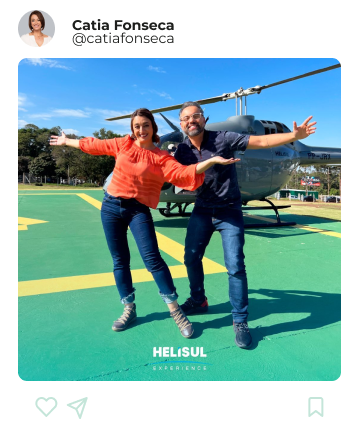

Veja quem já alçou voos

com a Helisul

Viva também essa experiência a bordo de uma das aeronaves da Helisul.

Nossos passeios

O que nossos viajantes aventureiros dizem

- anajusevicius

Um sonho - Fazer esse vôo faz você se sentir em um sonho, pois as Cataratas do Iguaçu é deslumbrante e vale a pena sobrevoa-la. Emoção a flor da pele, pena que é tão rápido!!!

Um sonho - Fazer esse vôo faz você se sentir em um sonho, pois as Cataratas do Iguaçu é deslumbrante e vale a pena sobrevoa-la. Emoção a flor da pele, pena que é tão rápido!!!

02/12/2021 - jamesrei2015

Fizemos o passeio em 4 pessoas com a maior segurança e comodidade. Recomendo este passeio a quem quem ter a emoção de conhecer as cataratas pelo alto.

Fizemos o passeio em 4 pessoas com a maior segurança e comodidade. Recomendo este passeio a quem quem ter a emoção de conhecer as cataratas pelo alto.

26/06/2022Prisci2la Vale cada minuto e cada centavo! - O passeio é maravilhoso! O local é muito organizado, os colaboradores não são muito simpáticos, com exceção da recepção, mas são eficientes ao receber, organizar os passageiros e colocá-los no helicóptero. Parece pouco tempo, mas é o suficiente para ver toda a área em torno das Cataratas brasileiras.

Vale cada minuto e cada centavo! - O passeio é maravilhoso! O local é muito organizado, os colaboradores não são muito simpáticos, com exceção da recepção, mas são eficientes ao receber, organizar os passageiros e colocá-los no helicóptero. Parece pouco tempo, mas é o suficiente para ver toda a área em torno das Cataratas brasileiras.

21/10/2022 -

Foi uma experiência única

Foi uma experiência única

A vista de cima é sensacional

Fiquei super emocionada e valeu por toda a viagem

Mas o voo sobre as cataratas foi uma emoção à parte

Super recomendo

Vale o custo beneficio

Micotinha

Micotinha

12/03/2024

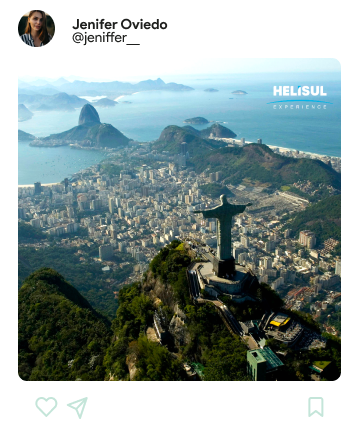

@helisulexperience

Vem com a gente?

Torne seu passeio inesquecível com os voos panorâmicos da Helisul Experience.